how to file back taxes without records canada

However this is only the. You can file your tax returns directly through a NETFILE-certified tax software which is more accurate with fewer chances of errors.

Taxes For Expats Filing And Preparation Expat Tax Online

Help Filing Your Past Due Return.

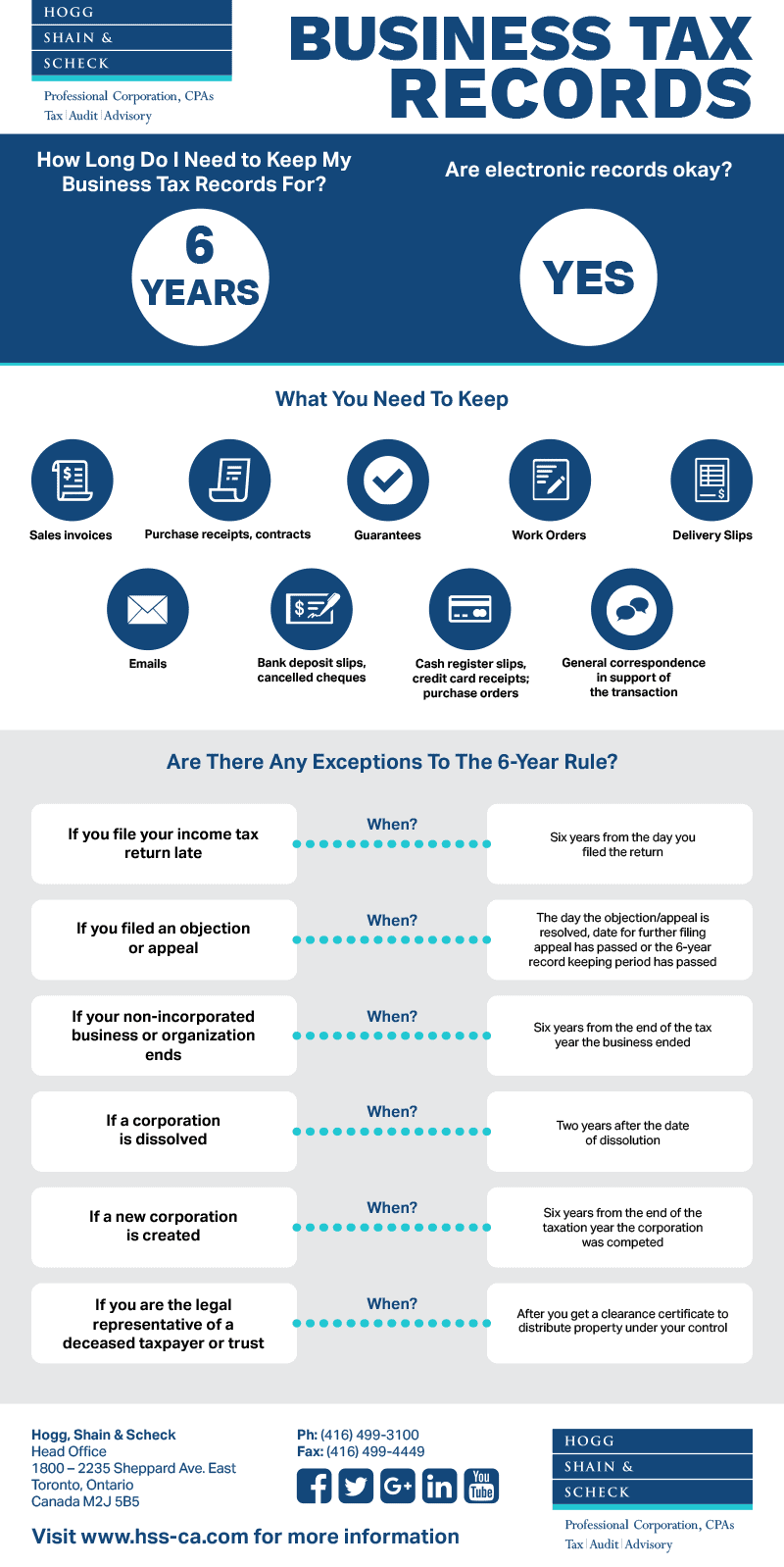

. Press question mark to learn the rest of the keyboard shortcuts. The six-year period starts at the end of the tax year to which the. Every time your employer or payer issues you a tax slip a copy is sent to Canada Revenue Agency CRA which means you can simply request copies for past years from CRA.

This an affordable option to hiring a tax accountant. Filing a tax return for a previous year isnt as hard as you may think but it does require a few steps. If you are uncertain check with CRA or an accountant.

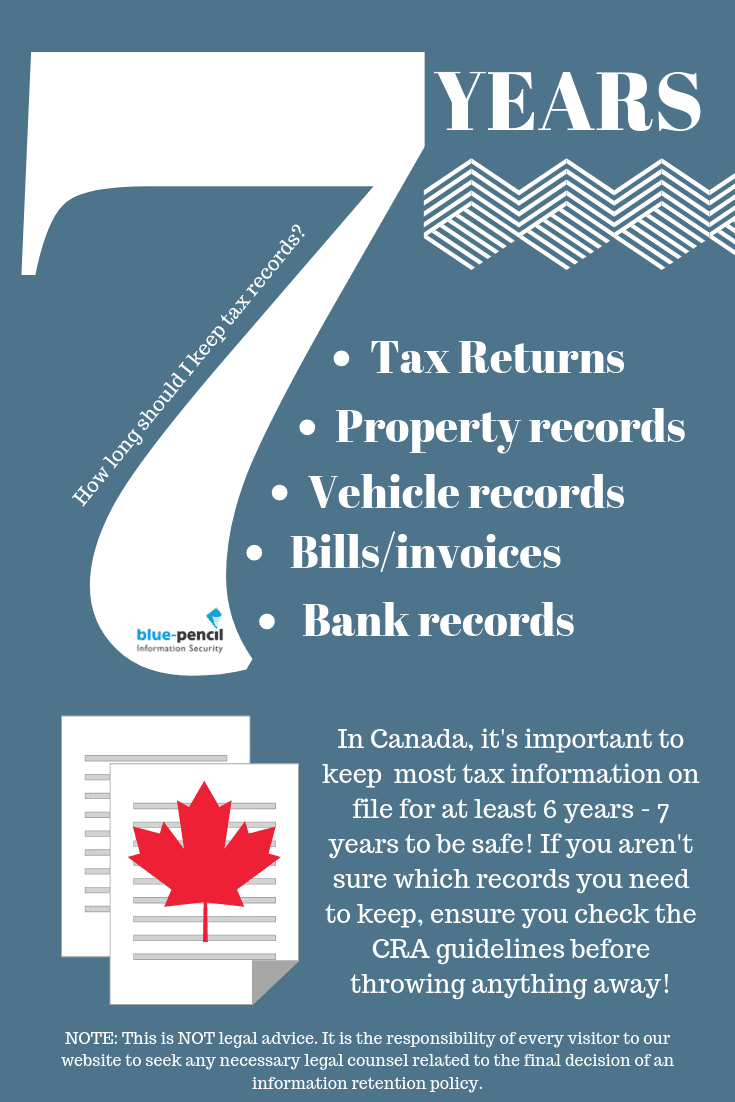

If you havent filed tax returns for previous years and you know youll have taxes to pay you may have another alternative. Press J to jump to the feed. This is the length of time youre legally required to hold onto old tax returns and supporting documents.

The rule for retaining tax returns and documents supporting the return is six years from the end of the tax year to which they apply. To do so visit the CRA My Account page and log in. If you are missing any slips or are unsure if you have them all you.

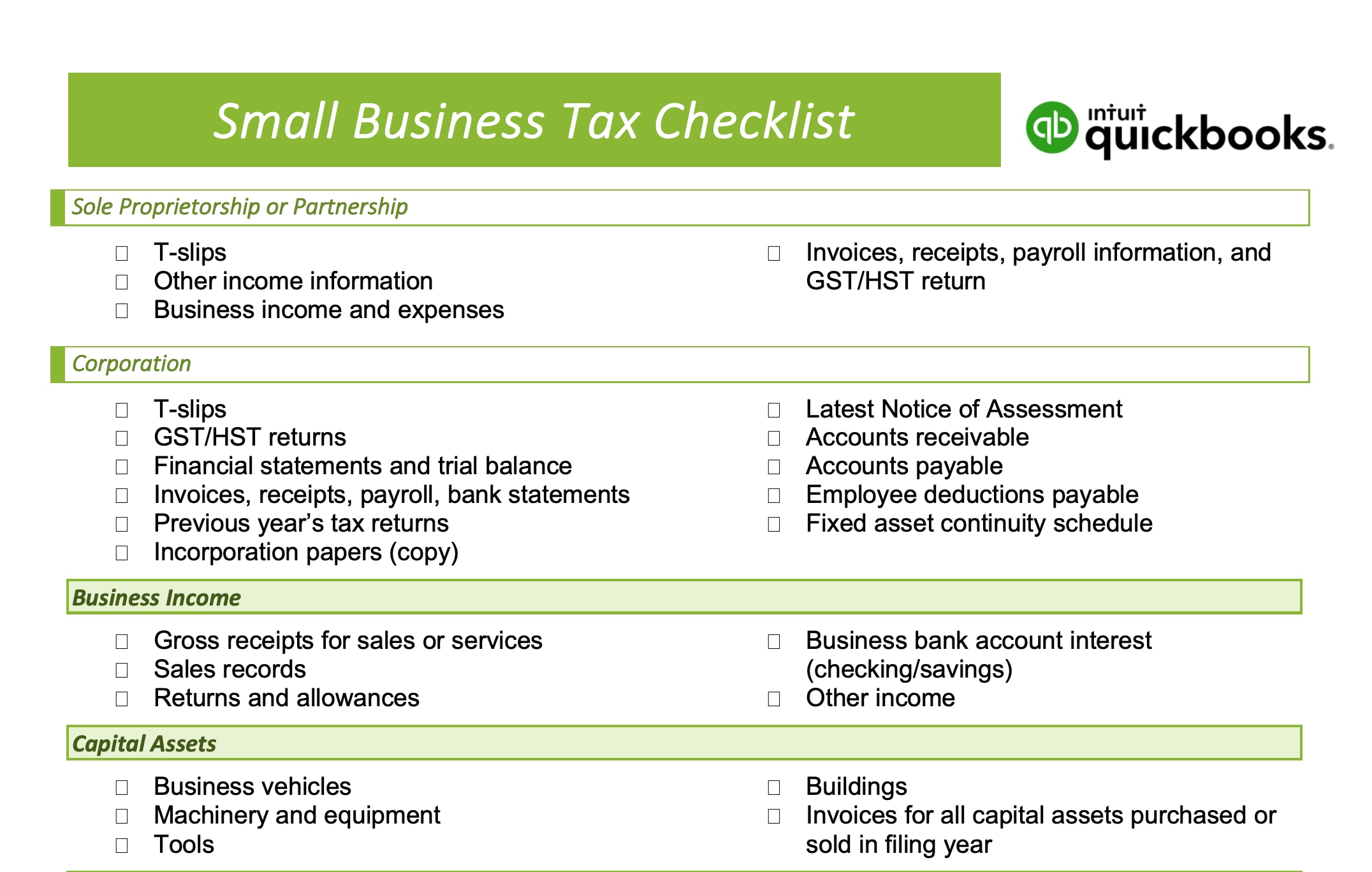

Tax accounting software is popular in small businesses and appears to be sufficient for personal income tax filing. These are the 2018. Access the EFILE web service to transmit your clients returns directly from your tax preparation software.

If youre self-employed youre responsible for deducting your income tax. Ad Get Back Taxes Help in 3 Steps. This means that if there were several years where you did not file your taxes or did not file your taxes correctly you need to submit.

The best way to repay back taxes is to simply complete. For personal returns you will need any and all T-slips such as T4s and T5s. How to file tax returns for previous years.

Use an EFILE certified tax calculation software package. We Can Help Suspend Collections Liens Levies Wage Garnishments. If the status of your tax return is listed as not received it means that the CRA has not officially received your tax return.

Failure to file a tax return. You get immediate confirmation that we have received. The experienced Chartered Professional.

Generally you cant make tax claims without receipts. Determine whether you need to contact a tax preparer or you can handle the back taxes on. For filing help call 1-800-829-1040 or 1-800-829-4059 for TTYTDD.

The IRS doesnt pay old refunds. They will take your previous five years income since you last filed and use that to estimate what your next five years income will be and. Its easiest to pay every month to avoid a.

The Canada Revenue Agency CRA has detailed information for situations where your records including those of your business are affected by a disaster. For example a 2015 return and its supporting. You can file a GSTHST return electronically by TELEFILE or on paper.

Ad Get Back Taxes Help in 3 Steps. Its called notional assessment. If you need wage and income information to help prepare a past due return.

For permission to keep records elsewhere write to your tax services office. For more information including. Housing corporations resident of Canada and exempt from tax under Part 1 of the Income Tax Act.

All of your claimed business expenses on your income tax return need to be supported with original documents such as. Confirm that the IRS is looking for only six years of returns. Contact Us by Email or call 1 855 TAX DOCS 1-855-829-3627 for a free no obligation consultation regarding all your back tax filing needs.

Bonus was that we didnt have to wait for an income tax return cheque in the mail because if we set up direct deposit the CRA would send it to use directly. Before you choose a method you must determine if you are required to file online and which online. Call the IRS or your tax pro can use a dedicated hotline to confirm the unfiled years.

The penalty for filing taxes late is 5 of the tax years balance owing plus 1 of the balance owing for each full month your return is late up to a maximum of 12 months. You must disclose all undisclosed information to the CRA. Steps to Filing Previous Years Tax Returns in Canada Do your Research.

We Can Help Suspend Collections Liens Levies Wage Garnishments. If you owe money to the CRA you will endure a late filing penalty of 5 of your unpaid taxes plus 1 a month for 12 months from the filing due date.

How To Prepare Your Crypto Taxes Bittrex Exchange

How To Organize Tax Documents Paperwork Receipts Part 7 Of 10 Paper Clutter Series Youtube

Tax Season Shredding What To Keep How Long Shred Nations

Should I Do My Own Taxes Or Hire An Accountant Use A Chart To Decide

Pin On Mind Strange Obsessions

Record Retention Policy How Long To Keep Business Tax Record

How To File Small Business Taxes Quickbooks Canada

How Long To Keep Tax Records In Canada Why

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

When Is It Safe To Recycle Old Tax Records And Tax Returns

How Long Do I Need To Keep My Business Tax Records For Are Electronic Records Okay What You Need To Keep Are There Any Excepti

Record Retention Policy How Long To Keep Business Tax Record

Record Retention Policy How Long To Keep Business Tax Record

Tax Season Shredding What To Keep How Long Shred Nations

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

Filing Your Tax Return Don T Forget These Credits Deductions National Globalnews Ca Income Tax Return Income Tax How To Get Money

Mak Financials Audit Services Business Tax Retirement Strategies

Record To Report Services Global Business Services Gbs Siemens Global