how does zillow calculate property tax

Zestimates are only as. Im starting to wonder if they are accurate.

6726 Starbuck Dr Dallas Tx 75252 Zillow Zillow Dallas Vacant Land

Finally the fourth home was a lakefront home in Elk Grove California.

. This flawed formula can lead to an inaccurate Zestimate of tens of thousands of dollars and in some cases hundreds of thousands. With VA loans your monthly mortgage payment and recurring monthly debt combined should not exceed 41. A list of our real estate licenses is available here.

To calculate the property tax the authority will multiply the assessed value of the property by the mill rate and then divide by 1000. Millage can be thought of as a proportional system of measure. Taxable value x total millage rate.

Unfortunately rarely does assessed home value have a correlation to market value. Market value x assessment ratio. I found a house that is listed at 170k.

The time that it takes to receive sale data varies widely among municipalities and largely depends on their systems to upload and share data. 10 mill levy 10 school district 10 township taxes which yields 30 or 12000 on a 400000 assessed new construction home purchase. So if you make 3000 a month 36000 a year you can afford a house with monthly payments around 1230 3000 x 041.

Property taxes are calculated by taking the mill levy and multiplying it by the assessed value of the owners property. Again the Zillow estimate was too low at 488711. But when the appraiser comes inside the condo to measure hes usually using a walls in measurement which often yields a square footage lower than what the architectural drawings state.

It says the property taxes last year were 2480 on an assessed value of 68650. A huge component in Zillows formula is assessed the home value or the value placed on a property for tax purposes which is usually only around 20 of the fair market value of the home. We can help with that.

Figures are based on information from sources like comparable sales and public data. There are typically multiple rates in a given area because your state county local. The assessed value estimates the reasonable market value for your home.

To estimate your real estate taxes you. Your Zillow Zestimate is updated daily. Depending on the size of the home.

Like other similar tools Redfin and Zillow calculate a homes estimated value using publicly available data like tax records recent property sales and local market trends. Note that the values for exemptions homestead credits. For example a property with an assessed value of 50000 located in a municipality with a mill rate of 20 mills would have a property tax bill of 1000 per year.

Holds real estate brokerage licenses in multiple states. Property tax before credits homestead credits and circuit breakers. Your estimated annual property tax is based on the home purchase price.

Your areas property tax levy can be found on your local tax assessor or municipality website and its typically represented as a percentagelike 4. That Zestimate was more than 20 too low. Holds real estate brokerage licenses in multiple provinces.

Assessed value exemptions. Price history is sourced from Internet Data. The estimator considers all of that information and uses it.

Ad Curious what you could get for your house. Zillows estimation is not including property taxes and insurance which will drive your payment up depending on how much they are. Which make it more like 700 more or less.

If you know the specific amount of taxes add as an annual total. Not to mention their estimate includes you putting 20 on the sales price. 442-H New York Standard Operating Procedures TREC.

So a loan of 104k 130 sales price - 26k down would be 500 a month plus property tax and plus insurance. Because the city says so. Zillow valued that home at 1230563 but it sold for 1495000 and for cash with no financing involved.

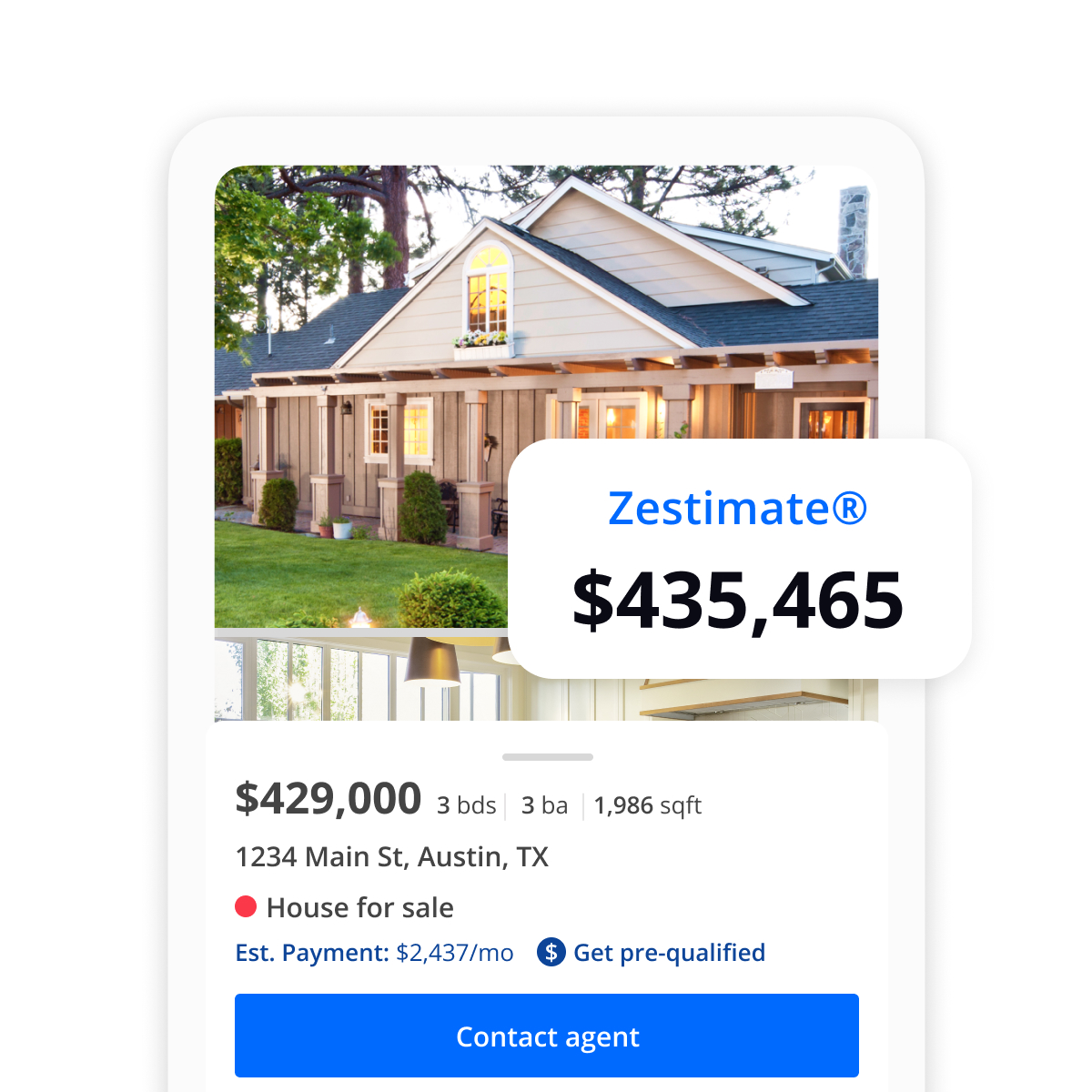

As a result a buyer they may think their potential new condo is 1600 sq. Information about brokerage services Consumer protection notice California DRE 1522444. Zillows Zestimates allows users to see how much homes are worth.

Use our VA home loan calculator to estimate how expensive of a house you can afford. Property Tax Before Credits. But the county rate and the town rate found elsewhere online put the property tax rate at 148 or 168.

Millage rates are typically expressed in mills with each mil acting as. The home sold for 16 more at 565500. The Zestimate is calculated through a Zillow algorithm that crunches data from public property records tax records recent home sales in the area and user-submitted information to come up with an approximate market value for a home.

File Your Taxes With HR Block. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. So if the assessed value of your home is 200000 but the market value is 250000 then the assessment ratio is 80 200000250000.

So the estimated property taxes on new construction homes in this area will be the sum of the mill levy plus the school district plus the township tax. The total is divided by 12 months and applied to each monthly mortgage payment. Tax assessment information is provided from public county records collected and aggregated by a third party data provider and then sent to us.

From what many have gathered one of the value factors that are at the top of Zillows formula is using a propertys assessed value from tax records. The market value of your home multiplied by the assessment ratio in your area equals the assessed value of your property for tax purposes. Total Property Tax Owed.

Accuracy matters a lot in this arena because many buyers and sellers use the online estimates to price their homes or make purchase offers literally handing sellers or buyers the estimates as. Home details like square footage location and the number of bedrooms and bathrooms. That works out to a property tax rate of more than 36.

Sign in to edit your home details. Please note that we can only estimate your property tax based on median property taxes in your area.

Danville Real Estate Danville Va Homes For Sale Zillow Property Sunnyside Zillow

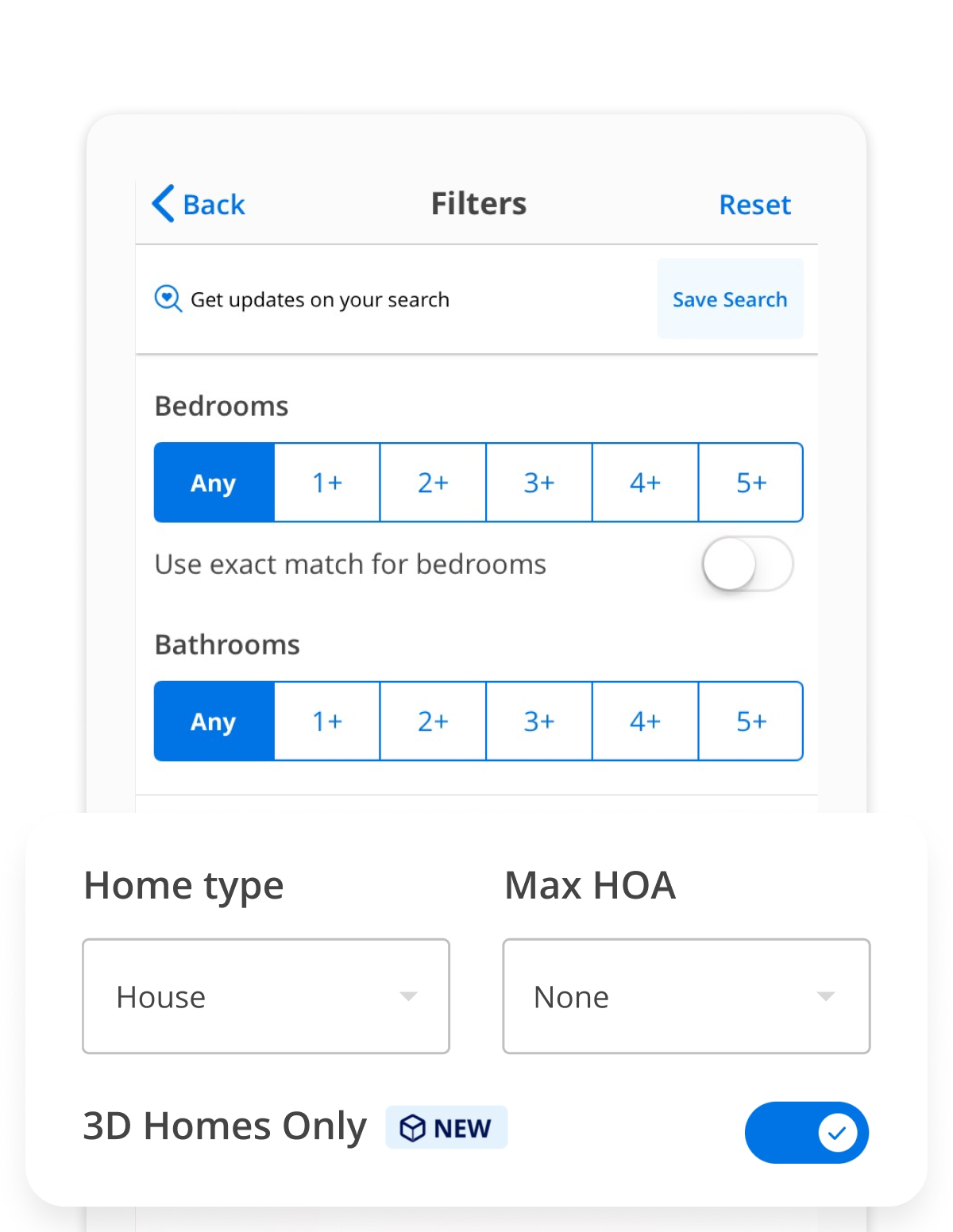

How To Find A House On Zillow With Advanced Search Techniques Zillow

What Does Tax Assessment Mean On Zillow How To Discuss

How To Find A House On Zillow With Advanced Search Techniques Zillow

Zillow Mortgage Calculator Https Www Zillow Com Mortgage Calculator Mortgage Calculator Mortgage Mortgage Payoff

27 Limetree Dr Manorville Ny 11949 Mls 3253790 Zillow Zillow Greenwood Village Townhouse

600 W Henderson St Salisbury Nc 28144 Mls 3461233 Zillow Salisbury Zillow Taxes History

12335 Stonebrook Dr Los Altos Hills Ca 94022 Zillow Tudor Style Homes Manor House Interior Tudor House

Pin On Real Advice For Buyers And Sellers

1113 Se 2nd St Crystal River Fl 34429 Zillow

Pin By Igor Mishur On Covered Decks Covered Decks Zillow Large Yard

Where Does Zillow Get The Price And Tax History Data For My Home Zillow Help Center

35565 Little Walluski Ln Astoria Or 97103 Mls 20 1162 Zillow Craftsman House Us Real Estate Zillow

Zillow Will Use Its Zestimate Tool To Make Cash Offers For Home Buying Service Geekwire

/x_reasons_zillow_estimates_are_not_as_accurate_as_you_think-5bfc3429c9e77c002631fd3e.jpg)